IMAGE: You may be eligible to receive hundreds of dollars in one-off payments from the Federal Budget(ABC News: Jessica Hinchliffe)

Source: ABCnews

What tax relief and payments will you get from the budget?

The Morrison government is handing out a few small payments and tax cuts to try to reduce your cost of living in the coming months.

However, many of them are one-off, or temporary, payments.

At the same time, much-larger tax cuts are still planned to go ahead from July 2024, which will clearly benefit higher-income earners, and which will be permanent.

Here’s how the tax changes and payments will affect you.

The $250 cost-of-living payment

First up, if you’re on a government payment, you could be eligible for a one-off “cost-of-living payment” worth $250.

It will be paid automatically in April, to six million Australians who are on various government payments, meaning you don’t have to apply or do anything to get it if you’re eligible.

The payment will be given to eligible recipients of the following schemes, and to concession card holders:

- Age Pension

- Disability Support Pension

- Parenting Payment

- Carer Payment

- Carer Allowance (if not in receipt of a primary income support payment)

- Jobseeker Payment

- Youth Allowance

- Austudy and Abstudy Living Allowance

- Double Orphan Pension

- Special Benefit

- Farm Household Allowance

- Pensioner Concession Card (PCC) holders

- Commonwealth Seniors Health Card holders

- Eligible Veterans’ Affairs payment recipients

- Veteran Gold card holders.

The $250 payment will be exempt from taxation and will not count as income support for the purposes of any income-support payment.

You’ll only be allowed to receive one payment, even if you’re eligible under two or more categories.

Cost-of-living tax offset, worth $420

This one is a tiny bit more complicated.

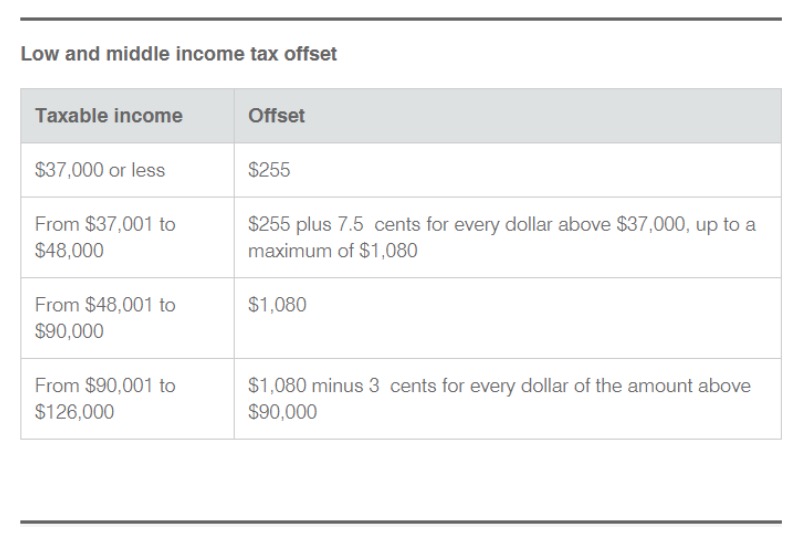

The government has chosen to phase out the so-called Low and Middle Income Tax Offset (LMITO), but it will increase the payment for everyone, by $420, for its last year of operation.

In 2019, the LMITO was introduced as a temporary measure only.

It has been giving annual tax cuts worth between $255 and $1,080, depending on your taxable income, to people earning below $126,001 a year.

However, this financial year (2021-22) will be its final year of operation.

When you file your tax return in the second half of this year, it will be the last time you’ll benefit from this relief.

Now, there had been speculation the government would want to keep the LMITO in place for another year at least, to reduce cost-of-living pressures for millions of taxpayers in an election year.

However, it costs $7 billion a year, so it’s scrapping it.

The government is trying to make the adjustment more politically palatable by giving practically all LMITO recipients a one-off payment, worth $420, for its final year of operation.

What about the stage three tax cuts?

Which brings us to a point of controversy.

By scrapping the LMITO after this financial year, the government has decided to effectively increase taxes on millions of Australians from next financial year.

Why? Because people have gotten quite used to the LMITO in recent years.

By getting rid of it, this means millions of people will have to adjust to life without the tax cut.

At any rate, as millions of people are finally adjusting to life without the LMITO, high-income earners will be preparing to receive large and permanent income tax cut.

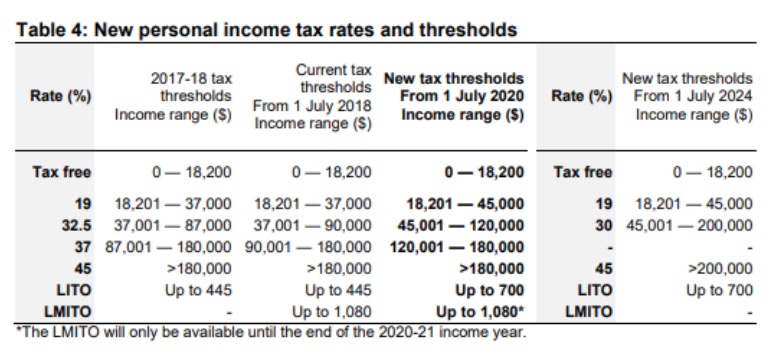

Why? Because a few years ago, the government legislated large changes for personal income taxes in the future.

And that future is almost here.

From July 1, 2024, the government’s so-called “stage three” tax cuts will:

- increase the income at which the top 45 per cent tax bracket begins from $180,001 to $200,001

- abolish the 37 per cent marginal tax rate

- lower the 32.5 per cent marginal tax rate to 30 per cent, leaving all earnings between $45,001 and $200,000 facing a marginal tax rate of 30 per cent.

You can see those changes illustrated in the table below.

According to the Morrison government, the changes will see around 95 per cent of taxpayers facing a marginal tax rate of no more than 30 per cent from 2024-25.

However, the largest tax cuts will go to the highest-income earners, and Labor has committed to keeping them.

According to The Australia Institute, people earning more than $200,000 will enjoy a permanent tax cut of $9,075 per year.

Its research shows average chief executives, federal politicians and surgeons will all get the maximum tax cut.

However, people earning less than $45,000 will get nothing at all from the stage three tax cuts, and middle-income earners will get little.

When the LMITO is phased out at the end of this financial year, it will see many low- and middle-income earners paying more tax than they have this year or last year.

“How is it reasonable that a bank CEO, earning $5.2m a year, will be given a $9,000 tax cut, while someone working in aged care or on the minimum wage receives nothing?” questioned the Australia Institute’s chief economist Richard Denniss.

Fuel excise cut by 50 per cent, for six months

Finally, there’s the much discussed fuel excise cut.

Australian motorists currently pay excise worth 44.2 cents on every litre of petrol or diesel they buy.

However, the government cut that excise in half, to 22.1 cents, after budget night.

And it plans to keep the cut in place for the next six months.

Treasurer Josh Frydenberg said the tax cut should flow through to prices at the bowser over the next two weeks.

“For the next six months, Australians will save 22 cents a litre every time they fill up their car,” he said.

“A family with two cars who fill up once a week could save around $30 a week, or around $700 over the next six months.”

The government said competition watchdog, the ACCC, will keep an eye on petrol retailers to ensure they pass the lower excise rate on to motorists.

The measure will cost the government $3 billion.

However, a word of warning: Be prepared for a potentially sudden spike in petrol prices when the six-month period ends.

On September 28, the fuel excise will suddenly revert to 44.2 cents per litre.