China issued a US dollar-denominated bond in Saudi Arabia, directly challenging the petrodollar system. Although the bond was relatively small, at $2 billion, the rate and uptake are noteworthy. China was able to issue US dollar bonds at essentially the same rate as the US, making them almost as attractive as UK gilts. This is not de-dollarisation, but re-dollarisation—using the US dollar to subvert the United States and this is essentially how China could re-dollarise without funding US wars.

The Bond Issue

For context, when Sri Lanka issued USD bonds in 2022, they traded at a roughly 9% premium (high risk). When Alibaba issued USD bonds in 2017, they traded at 1.08% above the rate (medium risk). However, when China issued bonds last week, they traded at just 0.007-0.029% above the rate (3Y/5Y) and were oversubscribed by 19.9 times. As one Chinese commentator put it (via Eric Yeung), “We replaced the Federal Reserve.” Not exactly, but you can see a Novus Ordo Seclorum taking shape.

The Money Issue

In the film Scarface, once Tony Montana started making vast sums of money, he faced a new problem: what to do with it? This was the dilemma faced by OPEC countries after the 1970s Oil Shock. Having nationalised their oil, they suddenly found themselves sitting on billions of dollars in oil revenue, with no idea how to manage it. That was until the colonial powers, who had tried to steal the oil, reached a cunning compromise: they allowed the petrostates to keep their money, provided they parked it in Western banks.

Ideally (and ideologically), that money should have been invested in other developing countries, but greed prevailed over solidarity. As Glenn Gray wrote, “Put simply, the oil producers did not want to bear the risk of pouring their earnings directly into developing countries.” Instead, “when the oil exporters shifted from short-term bank deposits to medium-term bond purchases, they favoured industrial nations like France, Japan, the US, and even (unwisely) Britain.”

OPEC countries ended up putting their money right back into “white” banks, slowly being recolonised in a new form. Today, OPEC is headquartered in Europe, and many of its founding nations have been overthrown, invaded, sanctioned, or occupied militarily. What oil-producing nations learned was that, while they might control the oil, if they don’t control the money, they don’t control anything.

What followed was an unwritten deal between the US (as the colonial heir) and Saudi Arabia (as the most petro-rich state). The US allowed them to make their money, as long as it was in US dollars. The Saudi riyal is not a true currency; it has been pegged to the US dollar since the 1980s. While people often claim that the US dollar is a fiat currency (i.e., it is essentially made up), it’s not. It is backed by oil, which is why it’s known as the petrodollar. This is what makes the symbolism of a Chinese bond issue in Saudi Arabia so striking: Saudi Arabia is the heart of the petrodollar, and China is now showing it can march to a completely different beat.

An Illustration

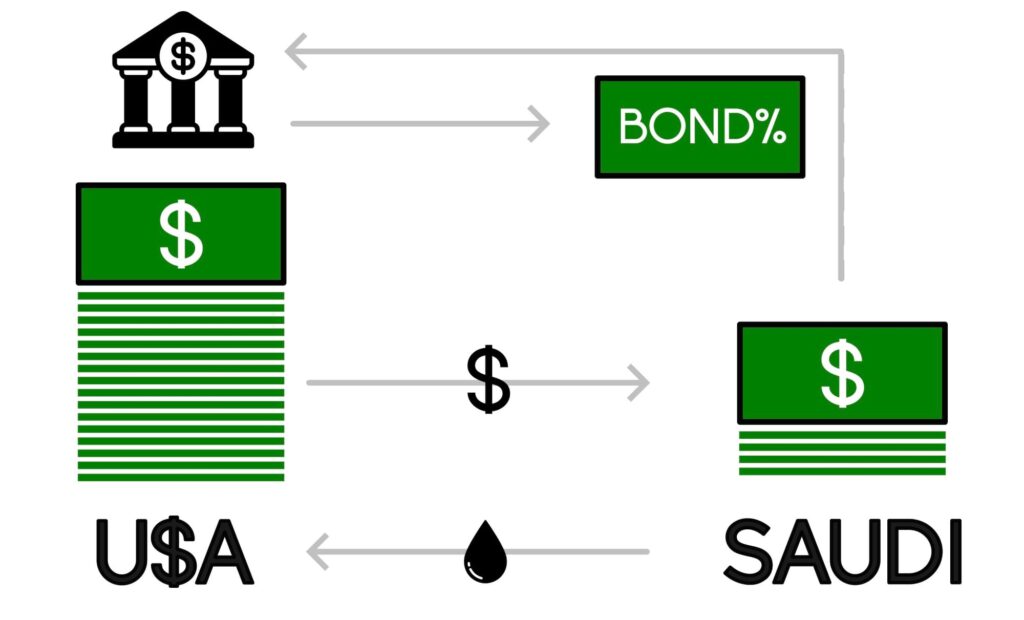

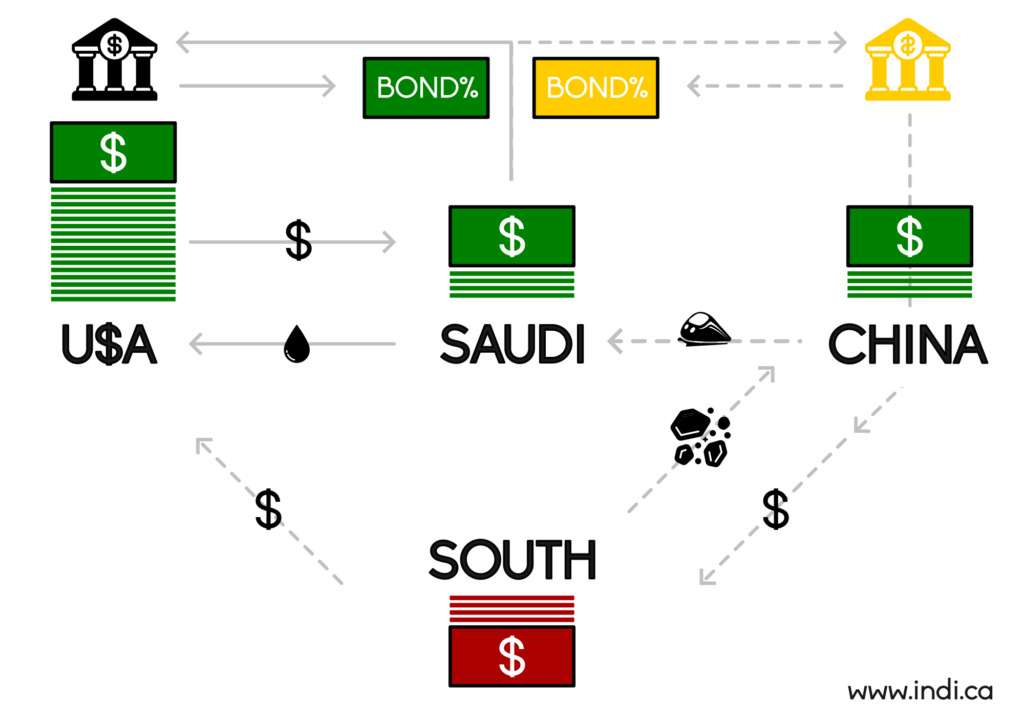

To illustrate the impact of this bond issue, let’s look at a simplified version of trade between the USA and Saudi Arabia.

Oldus Order Seclorum

(“old order of the ages”) is one of two Latin mottos on the reverse side of the Great Seal of the United States)

Saudi Arabia sells oil to the US, which pays in USD. Saudi doesn’t know what to do with these dollars, so it buys US Treasury bonds (bonds here). This is how the system traps them—through interest rates. The US financial system has two traps: the Debt Trap for poor countries and the Asset Trap for the rich. Saudi Arabia is in the latter, no matter how hard they try to break free. They may control their oil, but the US Federal Reserve controls their money—and that’s where the real power lies.

This system works as long as:

A) The House of Saud trusts the US to hold their money, and

B) The US dollar can buy the weapons and technology they need.

However, both of these conditions have changed. The US has weaponised its currency and its weapons have failed in the field. The US has sanctioned Russia, only to lose to Russian military power. It has sanctioned Yemen and been defeated in the Red Sea. Not to mention its failures in Afghanistan. The most expensive weapons in the world can’t subdue the poorest people.

America has broken the stick and eaten the carrot—now it’s unclear what motivates others to follow them, aside from sheer inertia. The US doesn’t manufacture anything worth buying, and its weapons are only good for slaughtering defenceless civilians. Even if US weapons were available, they look shoddy, and their currency looks questionable. Why should anyone buy into this system?

Novus Ordo Seclorum

(“New order of the ages”) is one of two Latin mottos on the reverse side of the Great Seal of the United States)

The answer—for those who haven’t already been kicked out—is TINA: There Is No Alternative, as Margaret Thatcher once said. However, excluding Russia from the global system has been a massive misstep because it exposed a clear alternative. Russia has not only survived but has prospered outside the US financial system (now exceeding Germany and Japan in GDP). Because Russia is so large and has such a strong real economy, everyone (including the US) has continued dealing with it.

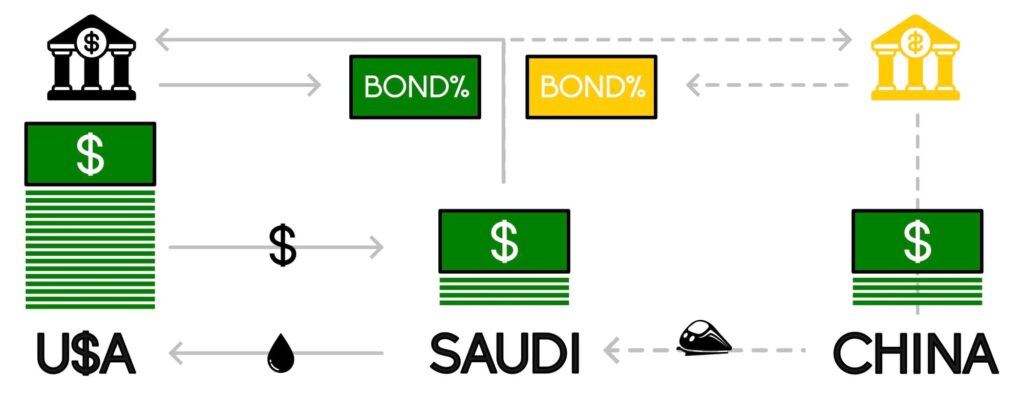

Seeing this, and recognising the writing on the wall, China is now working on its own exit strategy before it’s too late. It’s important to note that none of these nations wanted to de-dollarise—they’re being forced to by the US. In this context, the Chinese-Saudi bond issue can be seen as an experiment: What if, instead of de-dollarising, we re-dollarised? Keep the dollars but ditch the US. What might that look like?

In essence, it looks like this:

A reserve system with two reserve banks. In this (hypothetical) system, Saudi Arabia has a choice. It can either bank its dollars with the increasingly erratic US or with an increasingly powerful China. Instead of accepting payment in dollars, they simply use the dollars as scrip to obtain what they truly want—trains, military equipment that can be delivered in less than a decade. Taking this $2 billion bond issue as a test of the hypothesis, it half works. On a small scale, China was able to issue a USD bond at almost the same rate as the US Central Bank, with 20 times as much money waiting to be invested.

New World Order

Now, let’s get even more theoretical: what about the rest of the world? Remember, the original sin of OPEC was forgetting their colonised brethren. After their rebellion, they were recolonised. How could China go the full distance to financial liberation?

We turn to speculation from Chinese netizen Pingyuan Gongzi via Twitter. This is a translation, so please take it with a pinch of salt (and perhaps some chilli). Pingyuan Gongzi proposed the following:

“The process can be simplified as follows: we borrow US dollars from Saudi Arabia and then ‘give’ them to a third country. The third country repays US debt and provides us with resources. We give Saudi Arabia high-tech products. The US dollars from the Global South flow back to the US, driving up US dollar inflation, which accelerates Saudi Arabia’s ‘borrowing’ of US dollars… creating a perfect cycle. Saudi Arabia sells dollars, we get resources, the Global South countries repay US debts, Saudi Arabia gets high-tech products, and the US ‘gets’ dollars… It’s a win-win for all parties, and the whole world wins.”

“We’ve turned the US dollar into an ‘underlying asset’ rather than a currency. Today, we trade with many countries sanctioned by the US in this way—give me $10 million of oil, and I’ll give you $10 million of industrial products. The US dollar is simply a pricing tool, seemingly involved but not truly involved.”

“To eliminate ‘dollar hegemony’, it’s not necessary to eliminate the US dollar. We can make the US dollar an irrelevant unit of account.”

This has been made possible by China’s position as the world’s factory. Only China can produce industrial and high-tech products that others cannot get from the US or Europe. Additionally, China has a strong ability to maintain a trade surplus, always holding large amounts of US dollars. Whoever controls the US dollar holds the power, but China also possesses the necessary “martial virtues.” If another country helped the US issue US debt, the US Navy would likely show up. But when it’s China, the US must step back.

A New Financial Cycle

Rather than recycling dollars into the US system, this model suggests recycling dollars into China (which doesn’t want them either) and then into the Global South. The Global South countries then pay back America, breaking the cycle. This could allow the world to trade and invest in dollars without financing America’s wars.

While this idea is speculative and extrapolated from a small bond issue, it reflects a broader trend—wars, trade wars, and a looming economic depression. Meanwhile, everything we call ‘the economy’ is just a draw on the environment, which is collapsing around us. Everyone is selling bonds against a future that no longer exists—America, China, everyone.

We’re all playing a dangerous game of hot potato with a dollar that no one wants to hold. But the planet is burning regardless. In these heated times, it’s cold comfort to watch either the de-dollarisation or re-dollarisation of the world. The hegemony won’t stop killing until it can no longer profit from it.

What can the US do?

In effect this would China placing itself as an intermediary at the heart of the dollar system, where the dollars still eventually make their way back to the US – just through a path that builds Chinese rather than American influence and progressively undermines the US’s ability to finance itself (with all the consequences this has on inflation, etc.).

At this stage you probably tell yourself “come on, there’s no way China can do that, the US government surely has tools at its disposal to prevent this stuff”. And the answer, surprisingly, is that there is actually little the U.S. can do that doesn’t undermine them in some shape or form.

The most obvious response would be to threaten sanctions against countries – like Saudi Arabia – or institutions that buy Chinese dollar bonds. But this would further demonstrate that dollar assets aren’t actually safe from US political interference, further encouraging countries to diversify, compounding the problem. The dollar’s strength partly comes from network effects – everyone uses it because everyone else uses it – but as we’ve seen with Russia sanctions create a coordinating moment for countries to move away together, weakening these network effects.

Read more here –

Another option would be for the Federal Reserve to raise interest rates to make US Treasuries more attractive. But this would be self-defeating: it would increase the US government’s own borrowing costs at a time when they’re already struggling with massive deficits, potentially triggering a recession. And China, getting similar rates as the US, could simply match any rate increase.

The US could also go for the “nuclear option” of restricting China’s ability to clear dollar transactions but this would effectively immediately fragment the global financial system, undermining the dollar’s role as the global reserve currency – exactly what the US wants to avoid. And with China being the most important trading partner of the immense majority of the world’s countries, nothing is less sure that the U.S. would win at this game.

“Optimism that Trump will fulfill his promises to make the U.S. the “crypto capital of the planet” and Bitcoin a “permanent national asset” has made its price surge 20% in the week since his victory, reaching an all-time high of more than $93,000 per token and a market cap of over $1.8 trillion. This makes bitcoin the world’s seventh-largest asset behind gold and five U.S. tech giants, including Nvidia, Apple, Microsoft, Amazon and Google.